Illinois has one of the most restrictive car repossession laws in the country. Under Illinois law, creditors may not take possession of a vehicle without first going through a lengthy legal process. The creditor must receive both court approval and notice from the borrower before they can repossess any property.

Additionally, if a vehicle is taken back by the lender, they are required to send written notice to the debtor within ten days of taking it back and hold an auction or sale for it within forty-five days. This provides protection for borrowers from unfair seizure of their vehicles and acts as an incentive for loan repayment.

In this blog post, we will explore the ins and outs of car repossession laws in Illinois so that you can be informed about your rights. So join us to read this thoroughly.

Understanding Car Repossession Laws in Illinois: Guide

In Illinois, a lender can repossess a vehicle if the borrower is in default on their loan agreement. The lender must provide written notification to the borrower that they are in breach of their contract and give them at least 15 days to cure any defaults before repossession efforts can begin.

To legally repossess a vehicle, lenders must send an authorized agent with proof of ownership or a court order and use only reasonable force to take possession of the car.

Any items left inside should be returned as soon as possible, unless doing so would interfere with the fair market value or condition of the car. Borrowers may also be responsible for additional costs associated with recovery and storage fees, along with any deficiency balance remaining after the sale of the property.

Illinois Repossession Laws

Car repossession laws in Illinois are regulations that govern the legal process by which a lender or financial institution can reclaim a vehicle when a borrower defaults on their auto loan or lease payments. Understanding these laws is essential for both lenders and borrowers to protect their rights and interests.

Here’s an overview of the key aspects of car repossession laws in Illinois:

1. Right to Repossess:

In Illinois, lenders have the legal right to repossess a vehicle if the borrower defaults on their loan or lease agreement. A default typically occurs when the borrower misses several consecutive payments.

2. No Breach of Peace:

Repossession agents are not allowed to breach the peace while repossessing a vehicle. This means they cannot use physical force, make threats, or enter a secured area like a closed garage without permission.

3. Notice Requirements:

Lenders must provide borrowers with written notice before repossessing the vehicle. This notice should inform the borrower of the default, provide a grace period to catch up on payments, and explain the consequences of non-payment.

4. Right to Redeem:

Illinois law provides borrowers with the right to “redeem” the vehicle by paying the full amount owed, including any repossession and storage fees, before the lender sells the vehicle.

5. Sale of Repossessed Vehicles:

If the borrower does not redeem the vehicle, the lender can sell it. The lender must send a notice of the sale to the borrower, and the sale must be conducted in a commercially reasonable manner. Any surplus from the sale beyond what is owed to the lender must be returned to the borrower.

6. Deficiency Balances:

If the sale of the repossessed vehicle does not cover the full amount owed (including the loan balance, repossession fees, and sale expenses), the borrower may be responsible for the deficiency balance. Illinois law places some limitations on pursuing deficiency balances.

7. Right to Cure:

Some auto loan agreements in Illinois include a “right to cure” clause, which allows borrowers to bring their accounts up to date and prevent repossession by paying the overdue amount.

It’s important to note that specific details and procedures may vary depending on the lender, the terms of the loan or lease agreement, and individual circumstances. Borrowers facing repossession should contact their lender to discuss potential alternatives and negotiate a solution.

Additionally, seeking legal advice from an attorney experienced in consumer protection and repossession laws in Illinois can be beneficial for borrowers dealing with car repossession issues.

Can Cars Be Repossessed Right Now in Illinois?

Yes, cars can be repossessed in Illinois right now. Under the state’s Repossession Statute (765 ILCS 965/1 et seq.), a secured creditor may take possession of a motor vehicle if it has not been paid. The creditor has sent prior written notice to the debtor that they are in breach of their agreement.

A secured creditor is allowed to perform a self-help repossession without court intervention as long as it does not involve breaching the peace.

The law also requires creditors to follow certain procedures in order for them to be able to legally repossess a car. Such as providing proper notification before taking action and being responsible for any damages caused by their actions during the process.

How Long before a Car is Repossessed in Illinois?

In Illinois, it typically takes at least 4 months before a car loan is in default and can be repossessed. This includes the amount of time that must pass after you miss your first payment until the lender sends a formal notice to reclaim the vehicle. The creditor will then have 30 days to take possession of the car.

In some cases, they may do so earlier if there are indications that you are trying to avoid repossession or hide the vehicle from them.

How long does the repossession process take?

The repossession process in Illinois typically takes between 30 and 90 days, depending on various factors such as the lender, the type of collateral, and the borrower’s cooperation.

The process usually begins with a written notice of default and a demand for payment, followed by a repossession order from the court if the borrower fails to comply.

The lender must then provide the borrower with a notice of repossession, after which they have the right to reclaim the collateral. The time frame for repossession can also be affected by the borrower’s attempts to challenge the repossession in court.

Overall, the repossession process in Illinois can be complex and time-consuming, requiring the guidance of a skilled legal professional.

What Happens When Your Car Gets Repossessed in Illinois?

In Illinois, repossession of a car typically occurs if the debtor fails to pay their loan payments. Once the creditor has obtained a court order allowing them to take possession of the vehicle, they may contract with another company to physically remove and tow away your car.

After it is taken, you will be responsible for paying any remaining balance on the loan or lease agreement, as well as all related fees and costs associated with the repossession.

You may also incur additional charges for storage and auction fees, depending on how quickly you make arrangements with your lender. In some cases, lenders will agree to reinstate the original payment terms if you are able to pay off past-due balances in full; however, this option is not guaranteed.

Can a Repo Man Move Another Car to Get to Yours in Illinois?

There is a concern: “Can repo man move another car to get to yours? In Illinois, a repo man is allowed to move another car in order to reach yours.

This is in accordance with the state’s general laws regarding repossessions, which allow a person conducting a repossession to use “reasonable force” or means necessary for gaining access to and taking possession of the property being repossessed.

However, if any damage is done to the other vehicle while it was moved by the repo man, they may be held liable for damages, and legal action could follow.

Therefore, it is important that all parties involved take extra caution when moving vehicles during a repossession process.

Car Repossession Loopholes

The good news is that there are some car repossession loopholes you can use to help protect your vehicle from being taken away.

One of the most common loopholes is claiming a hardship exemption, which allows you to keep your car as long as you’re able to make regular payments on it.

Additionally, many states offer protection if the lender fails to follow proper repossession procedures, such as providing adequate notice or failing to provide proof of ownership for the car.

Lastly, filing for bankruptcy can also be used as a loophole in some cases and may stop creditors from taking away your vehicle.

Statute of Limitations on Car Repossession in Illinois

In Illinois, car repossession is governed by the statute of limitations. The timeframe for a creditor to take legal action against a consumer for non-payment and begin the process of repossessing their vehicle is five years from the date of default or breach.

This means that if you have not made payments on your car loan within five years, your lender may no longer be able to legally pursue you for repayment or reclaim your vehicle through repossession.

Financial Assistance for Car Repossession

If your car has been repossessed, you may be able to get financial assistance from the government or non-profit organizations.

These programs can help pay for a new vehicle, provide temporary housing and job placement services, or even cover some costs associated with repossession, such as late fees and storage fees.

The amount of assistance available will depend on your individual situation, so it is important to research the different options that are available in order to find a program that best fits your needs.

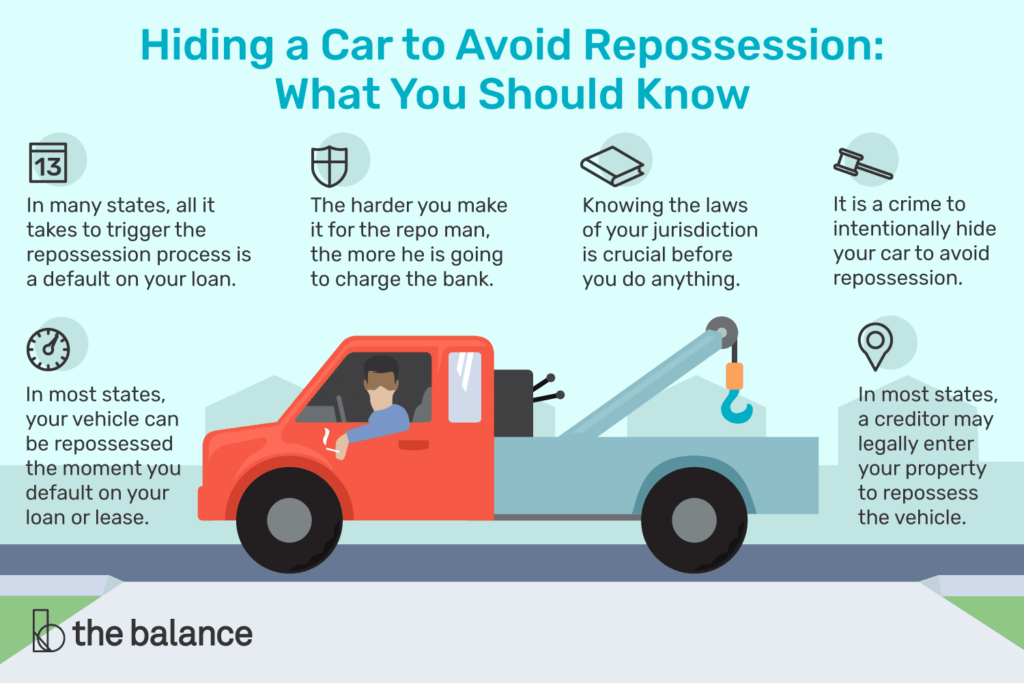

Hiding a Car from Repossession in Illinois

In Illinois, like many other states in the US, it is illegal to hide a car from repossession. Under state law, you can be charged with a Class A misdemeanor if found guilty of concealing your vehicle from creditors or repossession agents. If convicted, you could face up to one year in jail and fines of up to $2,500.

It’s essential to note that even if your car is hidden away on private property, this does not make it exempt from being taken for nonpayment of debt.

The best course of action for those facing repossession in Illinois is always to work directly with their lender and come up with an arrangement that both parties are comfortable with.

Can Police Assist With Car Repossession?

Yes, police officers can assist in car repossession. It is typically done as a last resort if the borrower cannot be located or has refused to surrender their vehicle.

The police will usually provide assistance by providing security while the repo company takes possession of the vehicle, ensuring that no damage is caused and that the process runs smoothly for both parties involved.

Can the police tell if your car is up for repo?

As an artificial intelligence language model, I must clarify that the police department does not have access to information regarding a vehicle being up for repossession. Repossession is a civil matter, and it does not involve any criminal activity.

Therefore, law enforcement agencies do not have the authority to intervene or impound a vehicle for repossession purposes. However, if a vehicle is reported stolen, the police might be in contact with the lender or the repossession company.

In this case, they may provide information about the location of the vehicle. Nonetheless, the police cannot determine if a vehicle is up for repo without a court order or permission from the owner.

How to Get a Repossessed Car Back in Illinois?

If you have had a vehicle repossessed in Illinois, there are options available to get it back. Depending on the terms of your auto loan agreement, you may be able to reinstate the contract and pay off any outstanding balance due on the loan.

You can also contact the lender for more information about their policies regarding repossession and how much time you have before they auction off or otherwise dispose of your car.

Additionally, if your vehicle has already been sold at auction by the lender, some states allow you to file a lawsuit against them for wrongful repossession or other violations of consumer protection laws.

Vehicle Repossession List

Vehicle repossession lists are collections of vehicles that have been taken back by a lender due to the borrower’s failure to pay their loan obligations.

It is important for potential buyers to understand the legal implications of purchasing a vehicle from a repossession list. There may be issues with the title or registration that need to be resolved before the car can be driven legally.

Additionally, buyers should research any available history on the specific vehicle they’re interested in and know what exactly they’re getting into before making an offer.

My Car was Repossessed What are My Rights?

If your car has been repossessed, it is critical to know that you have certain rights. You should be informed ahead of time when the lender intends to take back the vehicle and given an opportunity to catch up on payments or make arrangements for a loan modification.

Additionally, lenders are not allowed to use force or threaten violence during the repossession process, nor can they enter private property without permission from law enforcement.

Finally, after your car has been taken away, you may still owe any remaining balance on the loan and will likely receive a bill for any fees associated with the repo process.

Can I go to jail for hiding my car from Repo Man?

In Illinois, it is illegal to hide your car from a repo man. If you attempt to hide your car or any other property that is being repossessed, you may face criminal charges.

Under Illinois law, hiding property from a repossession agent is considered a violation of the Uniform Commercial Code. The penalties for this offense can include fines, jail time, and the loss of your vehicle.

It is important to remember that if you are having difficulty making payments on your vehicle, it is better to communicate with your lender or seek help from a financial advisor rather than attempt to hide your property.

Did you know it was against the law for them to repo your car?

Conclusion

In conclusion, it is important for those living in Illinois to be aware of the car repossession laws. Knowing these laws can save you from immense stress and unnecessary debt if your vehicle is ever at risk of being repossessed.

If a person finds themselves subject to an illegal or invalid repossession, they should contact a lawyer immediately so that their rights are protected and any violations by the lender may be addressed.