Buying a car is an exciting endeavor, but it’s crucial to make a decision that aligns with your financial well-being. One of the key factors to consider is how much car you can afford based on your salary. In this guide, we’ll explore the 20/4/10 rule, a widely recognized principle for car financing, and provide you with a practical calculator to help you make informed decisions.

Understanding the 20/4/10 Rule:

The 20/4/10 rule is a straightforward guideline designed to ensure that your car purchase remains within your financial means. Here’s a breakdown of the rule:

- Down Payment (20%): Start by making a down payment of at least 20% of the car’s purchase price. This reduces the loan amount and lowers your monthly payments.

- Loan Term (4 years): Aim to finance the car for a maximum of 4 years. A shorter loan term reduces the total interest paid and helps you pay off the car faster.

- Total Monthly Vehicle Expenses (10%): Ensure that your total monthly vehicle expenses, including the loan payment, insurance, and maintenance, do not exceed 10% of your gross monthly income.

Practical Application: Car Loan Calculator:

To simplify the process of determining how much car you can afford, we’ve created a user-friendly car loan calculator. You can find it here.

20/4/10 rule car calculator

Monthly Payment:

$0.00

1. Enter the car price, down payment, annual interest rate, loan term, and your gross monthly income.

2. Click the "Calculate" button to obtain your estimated monthly payment.

3. Check if the total monthly expenses fall within the 10% limit of your gross income.Formula to calculate, 20/4/10 rule car calculator

- Down Payment (20%): Pay at least 20% of the car’s purchase price as a down payment.

- Loan Term (4 years): Finance the car for a maximum of 4 years.

- Total Monthly Vehicle Expenses (10%): Ensure that your total monthly vehicle expenses (loan payment, insurance, and maintenance) do not exceed 10% of your gross income.

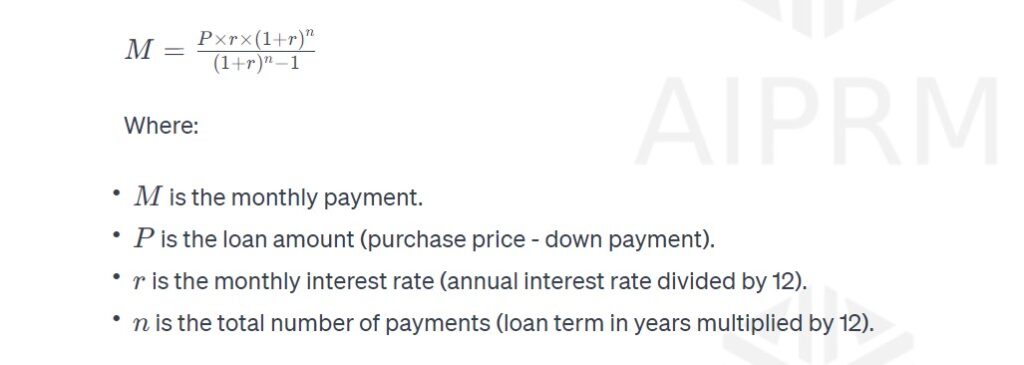

The formula for calculating the monthly loan payment can be based on the loan amount, interest rate, and loan term. The specific formula for this calculation is the loan payment formula, which is:

Where:

- M is the monthly payment.

- P is the loan amount (purchase price – down payment).

- r is the monthly interest rate (annual interest rate divided by 12).

- n is the total number of payments (loan term in years multiplied by 12).

To apply the 20/4/10 rule, you would calculate the monthly payment using the formula above and then ensure that this monthly payment, along with insurance and maintenance costs, does not exceed 10% of your gross income.

What is the 20/4/10 rule for buying a car?

The 20/4/10 rule is a guideline for car financing. It suggests making a down payment of at least 20%, financing the car for a maximum of 4 years, and ensuring that the total monthly vehicle expenses (including loan payment, insurance, and maintenance) do not exceed 10% of your gross monthly income.

What factors should I consider when using the car loan calculator?

When using the car loan calculator, consider entering accurate values for the car price, down payment, annual interest rate, loan term, and your gross monthly income. This ensures the calculated monthly payment aligns with the 20/4/10 rule.

Can I adjust the loan term in the calculator?

Yes, you can adjust the loan term in the calculator. However, it’s recommended to stick to the 20/4/10 rule by keeping the loan term within 4 years for optimal financial stability.

Conclusion

Making a well-informed decision when purchasing a car is essential for your financial stability. By adhering to the 20/4/10 rule and using our handy calculator, you can confidently determine how much car you can afford based on your salary. Remember, a thoughtfully planned car purchase contributes to a smoother financial journey.

Next time you find yourself asking, “How much car can I afford?” refer back to this guide for practical insights and use the calculator to make the process seamless. Happy car shopping!