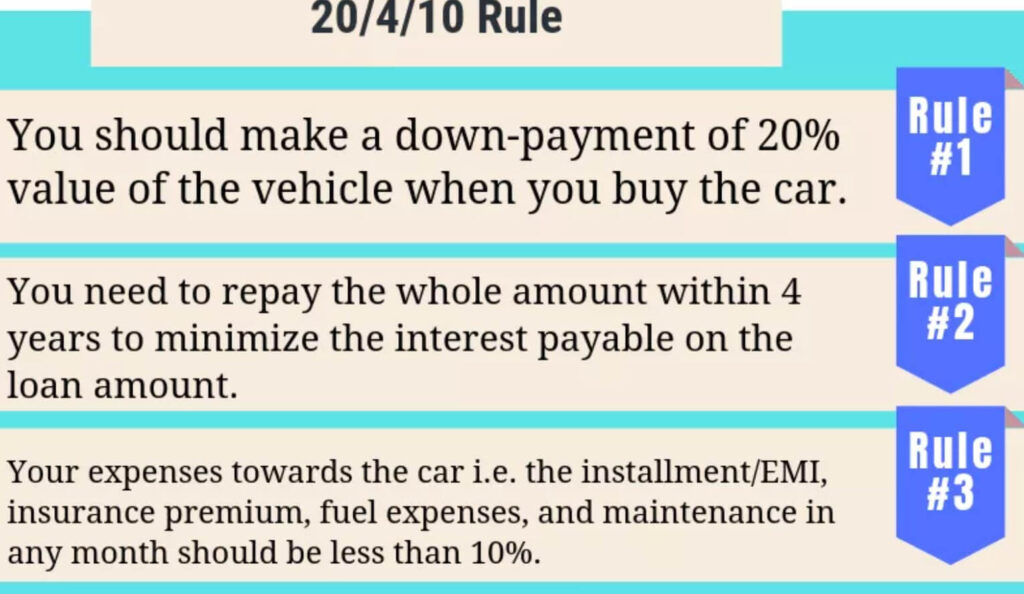

The 20/4/10 Rule is a guideline for how you should finance a car purchase. It states that you should make a minimum down payment of 20 percent, finance the vehicle for no more than 4 years, and keep your monthly payments to 10 percent or less of your total monthly income.

This rule helps buyers avoid overspending on their cars by keeping them from taking out too large of loans with long terms and high monthly payments that they cannot afford.

By following the 20/4/10 Rule, buyers can save money in the long run by avoiding excessive interest charges and staying within their financial means when purchasing cars.

What is the 20 4 10 Rule for Buying Vehicles?

The 20/4/10 rule is a guideline used by many car buyers to help determine how much of a down payment they should make when purchasing a vehicle.

This rule states that you should put down at least 20% of the cost as the initial down payment, finance no more than 4 years, and keep your monthly payments below 10% of your gross income. Following this rule can help buyers avoid going into too much debt and being upside-down on their loans for too long.

It’s important to remember that although this may be a helpful guide, everyone’s financial situation is different so it’s best to consult with an expert before making any decisions about financing or buying vehicles.

What is the 20 4 10 Rule Example?

The 20/4/10 rule is a simple way to help keep your car payments and other automobile-related expenses manageable. It stands for the recommended minimum amounts you should put down when buying a car (20%), the maximum amount of time you should finance it (4 years), and the highest monthly payment you can afford (10% of your gross income).

For example, if your annual salary is $50,000, then 10% would be $500 per month. This means that if you are looking at cars with a purchase price above $25,000 ($500 x 48 months = 24k) then you may want to look for less expensive options or save up more money for a larger down payment.

What is the 10 20 30 Rule Car?

The 10-20-30 rule is a fuel economy driving technique developed by the Environmental Protection Agency (EPA). It suggests that drivers should travel at a speed of no more than 10 mph over the posted speed limit on highways, 20 mph in city streets, and 30 mph in residential neighborhoods. This technique allows drivers to maintain an optimal balance between fuel efficiency and safety.

By following these guidelines, drivers can conserve fuel while still maintaining safe speeds for their vehicles; this can help reduce emissions and save money on gas costs.

Additionally, because it requires lower speeds when navigating through populated areas, it helps decrease noise pollution as well.

What is the 24-10 Rule for a Car?

The 24/10 rule is an important safety precaution for car owners. This rule states that a vehicle should be serviced at least every 10,000 miles or 24 months, whichever comes first. This means that regardless of how many miles you’ve driven your car in the past two years, it’s important to get regular tune-ups and maintenance checks done every two years to keep your car safe and running smoothly.

Regular service will help identify minor issues before they become major problems, leading to fewer costly repairs down the road.

Additionally, regular maintenance ensures all parts are working properly and not putting undue strain on the other components of your vehicle which can lead to bigger long-term issues if left unchecked.

How many cars Can I Afford (20/4/10 Rule)?

20/4/10 Rule for Buying a Car Calculator

The 20/4/10 Rule for Buying a Car Calculator is an online calculator that helps you calculate the ideal purchase price of your new car. This calculator takes into account factors such as taxes, fees, and percentage of income spent on car payments to determine what amount would be best for you.

It’s important to consider these financial obligations before making any major purchase decisions like buying a car. The 20/4/10 rule can help ensure that you don’t overextend yourself financially when purchasing your next vehicle.

Car Buying Rule Calculator

If you’re in the market for a new car, it can be overwhelming to figure out what your budget should be. A great tool that can help take some of the guesswork out of the process is a car-buying rule calculator.

This type of calculator takes into account factors like income, down payment, and monthly payments to give you an estimated cost range for different types of cars so you know what’s realistically within your budget.

20/40/10 Calculator

A 20/40/10 calculator can be used to determine how much car insurance coverage you should purchase. It is based on the rule of thumb that suggests drivers should buy $20,000 for bodily injury liability (BIL) per person, $40,000 for BIL per accident, and $10,000 for property damage liability (PDL).

This calculator will help you understand what type of coverage you need to protect yourself financially in case of an accident.

20/4/10 Rule Calculator Bank rate

The 20/4/10 Rule Calculator Bank rate is a great tool to help consumers decide when they are ready to purchase a car. It provides an easy way to determine the amount of money needed for a down payment, the length of time it will take to pay off the loan, and what monthly payments should be.

This calculator can provide helpful guidance for those looking for an affordable car loan option that fits their budget.

2410 Rule for a Car

The 2410 Rule is an important safety rule that applies to all cars and other vehicles. This rule requires that any vehicle be able to stop within a distance of 24 feet in 10 mph, or less.

Failure to do so can result in fines, points on your driving record, and even the suspension of your license.

Drivers need to ensure they are aware of this rule when behind the wheel and make sure their car meets its requirements accordingly.

20/4/10 Rule Reddit

The 20/4/10 Rule is a guideline for Reddit users that suggests spending no more than twenty minutes browsing the site, posting four times in total, and not visiting the platform more than ten times per day.

The idea behind this rule is to help users stay focused on their tasks while also engaging with Reddit’s content responsibly.

This can be a great way to get involved in the community without being overwhelmed or contributing too much of your time online.

20/4/10 Calculator Excel

The 20/4/10 calculator Excel spreadsheet can be used for a variety of purposes, including budgeting and loan payments. This calculator allows you to input various parameters such as the total amount borrowed, interest rate, monthly payment amount, and number of years to pay off the loan.

It then calculates the monthly interest charges, principal paid each month, and remaining balance at any given time.

This versatile tool can help you make sure that your financial obligations are met without sacrificing important goals such as saving for retirement or paying down debt.

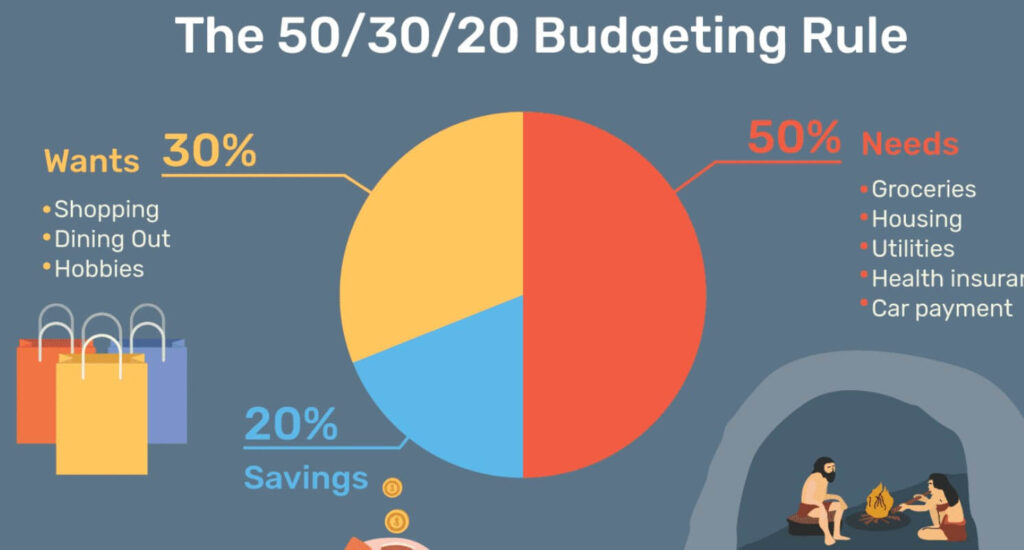

50/20/30 Rule

The 50/20/30 Rule is a budgeting strategy that suggests allocating your income in the following way: 50% of your after-tax income should go towards basic needs and living expenses, 20% should go towards financial goals such as savings and debt repayment, and the remaining 30% can be used for discretionary items like entertainment.

This rule provides an easy way to manage finances while still allowing room for some fun.

Conclusion

The 20/4/10 rule is a great way to ensure that you purchase a reliable car and set yourself up for success. This helpful tip can help you save money, stress, and time as you look for the perfect vehicle.

The next time you’re in the market for a new or used car, consider following the 20/4/10 rule to make sure that your purchase is both affordable and dependable.